- calendar_month September 24, 2024

- folder Real Estate Tips

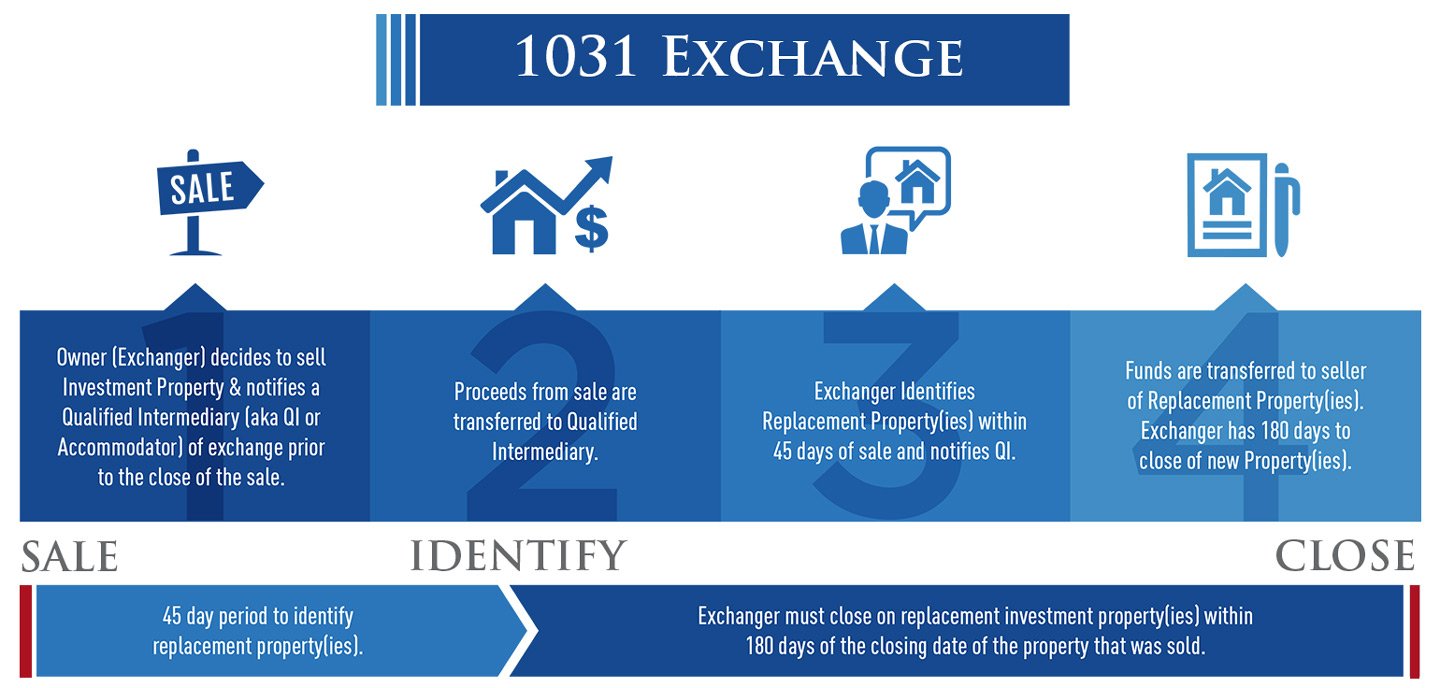

Navigating the complexities of the IRS tax code, especially concerning 1031 Exchanges, can be challenging. Here’s a straightforward guide to help you understand which properties qualify for a 1031 Exchange, allowing you to defer capital gains taxes effectively.

Defining Like-Kind Real Property

Like-Kind Property: Properties held for:

- Productive use in a trade or business, or

- Investment purposes.

Real Property: This typically includes interests in land and permanent improvements attached to the land.

In essence, for 1031 Exchange eligibility, the property must be used for business or investment purposes and include inherent elements like land and buildings.

Examples of Eligible Properties

-

Rental Properties:

- Must be rented out at Fair Market Rent (FMR) to a non-family member.

-

Business Use Land:

- Land utilized for business activities like storing equipment qualifies.

-

Commercial Properties:

- Buildings used for business operations, including permanently attached equipment but excluding movable furniture and inventory.

-

Mixed-Use Properties:

- Multi-unit buildings where portions are rented can qualify for the rental portions.

-

Delaware Statutory Trusts (DSTs):

- Fractional ownership in these trusts is considered real property by the IRS.

Examples of Ineligible Properties

-

Primary Residences:

- These benefit from the 121 Exclusion for capital gains but do not qualify for 1031 Exchanges.

-

Real Estate Investment Trusts (REITs):

- Shares in REITs are regarded as personal property, not real property.

-

Personal Property:

- Includes stocks, bonds, partnership shares, and other tangible/intangible assets.

-

Inventory:

- Properties held solely for resale, like flips or developments, are considered inventory and are not eligible.

Important Considerations

- Leasing to Family: Renting below FMR, even to relatives, disqualifies the property.

- Commercial Equipment: Permanently attached structures qualify, but removable items like furniture or inventory do not.

- Mixed-Use Properties: Only the portion used for rental or investment is eligible.

Conclusion

Understanding what constitutes eligible property for a 1031 Exchange is crucial for successfully deferring capital gains taxes. While this guide provides a comprehensive overview, it’s always advisable to consult with a tax professional to ensure compliance and make informed decisions tailored to your particular situation. Happy investing!